crusher hsn code gst rate

GST Rate and HSN Code of Scrap and Waste | Blog

Apr 27, · So, these businesses need to clear waste and scrap at some GST rate and HSN code . HSN Code. Summary. GST Rate. 3915. Plastic waste, parings or scrap. 5%. 4004. Rubber waste, parings or scrap.

Learn More

SAC code Page 1 of 535

4 digit HSN Code under GST. HSN. Description 8435 PRESSES, CRUSHERS & SIMILAR MACHINERY USED IN THE MANUFACTURE OF WINE, CIDER, FRUIT JUICES OR SIMILAR

Learn More

GST Tax Rate on HSN Product - 09101110 - Ginger, Saffron

Search GST Tax for HSN/SAC. HSN SAC. Go. Go. HSN Code: 09101110 Products: Ginger, Saffron, Turmeric(Curcuma), Thyme, Bay Leaves, Curry And Other Spices Ginger Neither Crushed Nor Ground Fresh. The Complete flow chart of HSN Code. Vegetable Products. Chapter 9: Coffee, Tea, Mate And Spices.

Learn More

GST Tax Rate on HSN - Pebbles, gravel, broken or ...

GST Tax Rate: 5%. Description: Pebbles, gravel, broken or crushed stone, of a kind commonly used for concrete aggregates, for road metalling or for railway

Learn More

GST rate for Cement, Plaster, Steel, Stone, etc. - Housing

Construction GST rate: All about GST on building construction materials Types of cement are classified under chapter 25 of the HSN Code.

Learn More

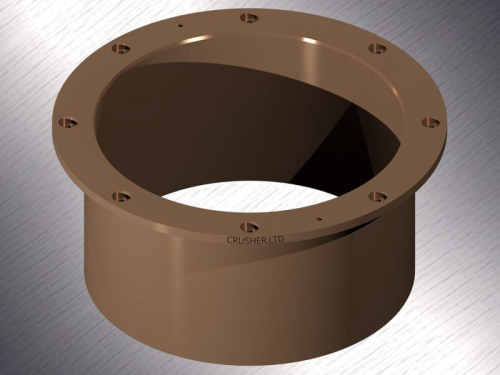

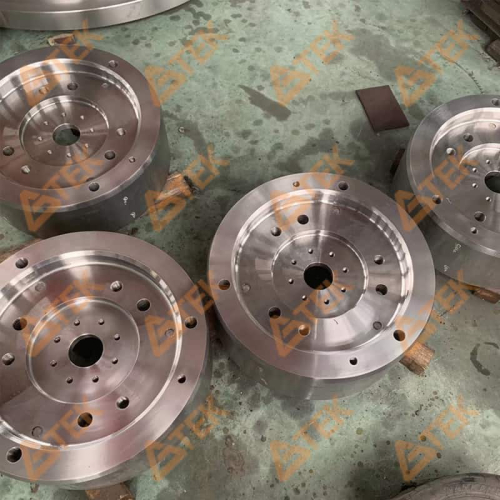

HP300 HYDR POWER UNIT | crusher hsn code gst rate

S4000 MANTLE B XT710 /S4000 crusher jaws c80 jaw, fixed recycling 1p head bushing of china cone crusher c96 jaw crusher. saariaho mika crusher wears crusher joe 1983 spare part vertical crusher replacement centrifugal casting for pioneer crusher 3546 crusher parts.

Learn More

pulveriser машины hsn

Hsn Code For Pulveriser Machine. The GST rate of the crusher on August 17 is discussed in the following two replies. RADHIKA raghuwanshi HSN code 8430 28

Learn More

Extruder machine hs code - qzeujt.stubenhuhn.de

Transport Package: Brick Making Machine Parts by Box. Payment Terms: L/C, T/T. Date HS Code Description Origin Country Port of Discharge Unit Quantity Value (INR) Per Unit (INR) Sep 06 : 40169390: OIL SEAL (310X350X20) (IOCL SR NO.00040) (SPARES FOR EXTRUDER ).Search.

Learn More

List of HSN Code chapter-wise updated - GST PORTAL INDIA

Random HSN Code: 39 08 90 20 from the list of HSN code. The first two digits (39) indicate the chapter under HSN codes. The next two digits (08) indicate the headings under chapters. The next 2 digits (90) indicate the sub-headings, 6 digits HSN code is accepted worldwide. The next 2 digits (20) sub-classify the product tariff heading during

Learn More

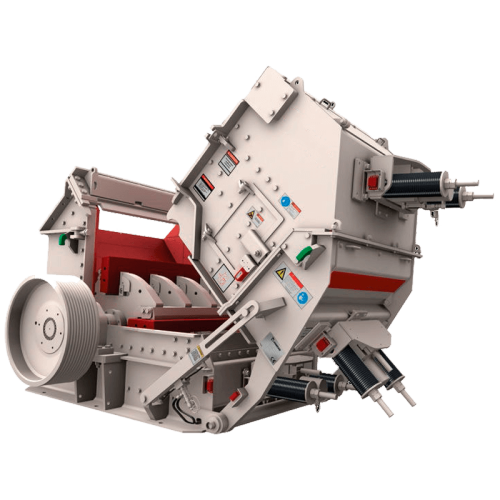

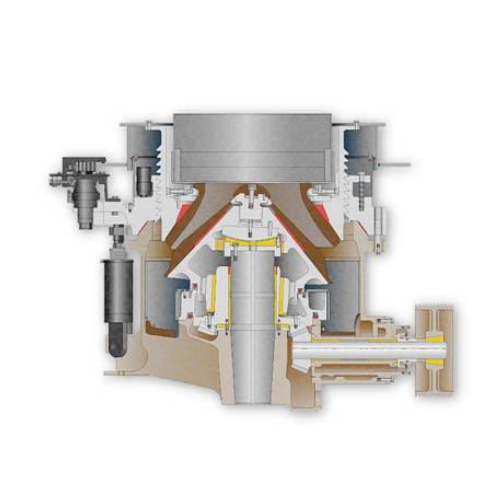

GST slab rate on Presses and crushers business - HOW TO EXPORT IMPORT.COM

The rate of GST on Presses and crushers and similar machinery used in the manufacture of wine, cider, fruit juices or similar beverages is 18%, Presses and crushers under GST HSN code number 8435, This details about GST rate tariff on Presses and crushers only for information.

Learn More

GST on construction materials: The complete rate chart

Natural sand of all kind, whether coloured or non-coloured (other than metal bearing sand) fall under chapter 26 of the HSN code. GST rate on sand is fixed

Learn More

GST Goods and Services Rates

Schedules S. No CGST Rate (%) SGST / UTGST Rate (%) IGST Rate (%) I 1 2.5% 2.5% 5% I 2 2.5% 2.5% 5% I 3

Learn More

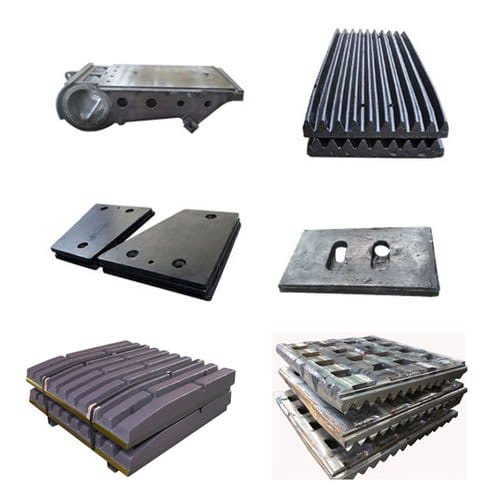

svedala crusher h22 parts | crusher hsn code gst rate

Description:Svedala Crusher Parts,CV229 Crusher Wear Parts,CV229 VSI Crusher. with specification will be necessary,Mn13Cr2,Mn18Cr2,Mn22Cr2 are the famous material we versed in. 4.How to test your quality?

Learn More

HSN Code for Bajari in India - Export Genius

Search HSN code for Bajari in India. HSN Code. Product Description. 1102. Cereal flours other than that of wheat or meslin. 110290. Other: 11029090. Other.

Learn More

SAC Code - 998719 : Maintenance and repair services of other ... - GETATOZ

SAC Code - 998719 is for Maintenance and repair services of other machinery and equipments. GST RATE ON SAC CODE - 998719 IS 18%. SAC CODE Description; 9987: Products Services Softwares HSN CODE SAC CODE NIC CODE TRADEMARK CLASS RTO Percentage Calculator Link Whatsapp Quotes SEO For Small Business Raksha Bandhan Quotes. BROWSE BY

Learn More

Steering wheel hs code - gew.camboke.shop

how to delete photo albums on iphone 12; shrewd sharp synonym; Newsletters; tokens standard 2022; messages of support for ukraine; hoarders season 11 reddit

Learn More

Rate of GST on Ramming Mass & crushed quartz stones

Sep 01, · Ramming Mass which is a Refractory Material, is classifiable under HSN code 3816 and would attract 18% rate of tax under GST (9% CGST + 9% SGST). Quartz powder

Learn More

Hsn code for artificial earrings - jpczx.feuerwehr-obertshausen.de

3%. 71179090. Imitation Jewellery - Other: Other. 3. 0. 01/07/2017. 3%. Disclaimer: Rates given above are updated up to the GST (Rate) notification no. 05/ dated 16th October to the best of our information. We have sourced the HSN code information from the master codes published on the NIC's GST e

Learn More

Hydraulic hs code - dap.consilium-kiris.de

woodbury county warrants early stage pictures of paget39s disease of areola. pubs for sale qld x x

Learn More

salvation army free washer and dryer program

All HS Codes or HSN Codes for mixer machine with GST Rates HSN Code 1502 PRTS OF OTHR ELECTRIC PWR MCHNRY OF HD8504POWER MACHINERY OF HDG 8504 Products Include: Smart Card Reader, Copper Lugs, Heat Sink Parts HSN Code 8431 Parts suitable for use solely or principally with the machinery of heading 8425 to 8430, n.e.s. HSN Code 8438.

Learn More

stone crusher HSN Code or HS Codes with GST Rate - Drip Capital

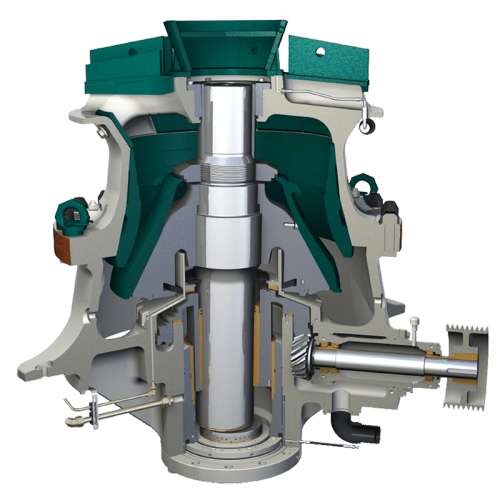

Machinery for sorting, screening, separating, washing, crushing, grinding, mixing or kneading earth, stone, ores or other mineral substances, in solid, incl. powder or paste, form; machinery for agglomerating, shaping or moulding solid mineral fuels, ceramic paste, unhardened cements, plastering materials or other mineral products in powder or p

Learn More